We now offer Electronic filing (IFTA E-file) support for the following jurisdictions: CA, CT, KY, MA, MD, ME, MI, MN, and NH. My Fuel Tax can create IFTA report .csv files that can be uploaded to the e-file pages of these states. It’s the fastest e-file system for IFTA fuel tax reporting yet, plus you can check the amount due calculated by the e-file site against the totals calculated by My Fuel Tax. This way you know when it is right!

If you know of other states that have IFTA E-file and support the capability to upload files to their e-file site, please feel free to contact us and we will develop a solution for that state as well.

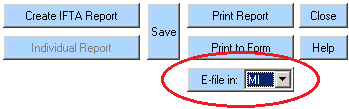

The IFTA E-file feature is very easy to use. You simply click on the button as below:

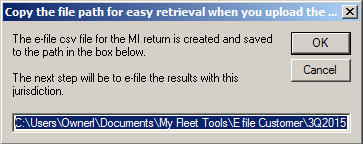

Then the IFTA E-file dialog below shows up:

Now you press Ctrl-C to copy the path to the buffer, then you click OK and you will be redirected to the e-file portal of your jurisdiction. There you login, click upload csv file and paste the buffer in the path. The upload file name will be of the form: FleetName_3Q2017_Upload.csv.

That’s all there is to it.